Last Updated on June 12, 2024 by Yasmina

Purchasing a property in Lombok, Indonesia, can be a fantastic investment or a dream come true for those seeking a tranquil and beautiful place to live. However, budgeting for a significant purchase requires careful planning and understanding of all associated costs.

This guide will help you navigate the financial aspects of buying a property in Lombok, ensuring you are well-prepared for every expense.

Table of Contents

Introduction

Lombok is an increasingly popular destination for property buyers. Whether you’re looking for a vacation home, an investment property, or a place to retire, understanding the full financial commitment is crucial.

This guide breaks down the costs involved and offers budgeting tips effectively.

1. Determine Your Lombok Property Purchase Budget

Assess Your Financial Situation

Before entering the property market, examine your financial situation closely. Determine how much you can afford to spend without compromising your financial stability.

- Savings: Consider how much you have saved and will allocate towards the property purchase.

- Income: Factor in your monthly income and any other sources of revenue.

- Debts and Obligations: Account for any existing debts or financial obligations that may affect your purchasing power.

Set a Maximum Budget for you Lombok Property Purchase

Based on your financial assessment, set a maximum budget for your property purchase. This budget should cover the property price and all additional costs involved in the purchase process.

2. Research Property Prices in Lombok

Understand Market Trends

Research current market trends in Lombok to get a sense of property prices. Prices can vary significantly depending on the property’s location, type, and condition.

- Villas: Prices for villas in popular areas like Senggigi, Kuta, and the Gili Islands can range from $100,000 to $500,000 or more.

- Apartments: Apartments in urban areas like Mataram typically cost between $50,000 and $200,000.

- Land: Land prices vary widely, from $10 to $100 per square meter, depending on proximity to tourist areas and development potential.

Compare Different Areas

Different areas in Lombok offer different price ranges and benefits. Compare various locations to find the best fit for your budget and preferences.

3. Factor in Additional Costs in your Lombok Property Purchase

Notary Fees

A notary (Pejabat Pembuat Akta Tanah or PPAT) is essential for handling the legal aspects of the property transaction. Notary fees typically range from 1% to 2% of the property’s value.

Transfer Tax (BPHTB)

The transfer tax is a mandatory cost when purchasing property in Indonesia. The rate is 5% of the property’s sale value or the government-assessed value, whichever is higher.

Legal Fees

Hiring a local lawyer to ensure all legal requirements are met is advisable. Legal fees can vary but generally range from $1,000 to $3,000, depending on the complexity of the transaction.

Real Estate Agent Fees

If you use a real estate agent to help find and purchase your property, expect to pay a commission fee. This is typically around 5% of the property’s purchase price.

Survey and Inspection Fees

Before finalizing the purchase, it’s wise to have the property surveyed and inspected for any structural issues or encroachments. These fees can range from $200 to $1,000, depending on the property’s size and location.

Administration and Registration Fees

These fees cover the cost of registering the property and transferring the title at the National Land Agency (Badan Pertanahan Nasional or BPN). They can range from $100 to $500.

Property Maintenance and Management Fees

For those not residing full-time in Lombok, hiring a property management company to maintain the villa can be beneficial. Fees typically range from $100 to $500 per month, depending on the services provided.

Insurance

Property insurance is crucial to protect your investment. Costs will vary based on the property’s value and coverage type, typically ranging from $500 to $2,000 annually.

Renovation and Furnishing Costs

If the property needs renovation or furnishing, these costs should also be included in your budget. Renovation costs can vary widely depending on the extent of the work required.

4. Plan for Ongoing Costs

Utilities and Maintenance

Monthly expenses for utilities (electricity, water, internet) and regular maintenance should be part of your ongoing budget. These costs can range from $50 to $150 per month.

Property Taxes

Annual property taxes in Indonesia are relatively low compared to many Western countries but should still be factored into your budget. The amount depends on the property’s value and location.

5. Secure Financing if Needed

Mortgage Options

While it can be challenging for foreigners to obtain a mortgage in Indonesia, it is not impossible. Research local banks and financial institutions that offer mortgage options to expatriates.

Alternative Financing

Consider other financing options such as personal loans, borrowing from family or friends, or financing from international banks.

6. Create a Detailed Budget Plan

Use a Budget Template

Utilize a budget template to organize and track all expenses related to the property purchase. This should include initial costs, ongoing costs, and contingency funds.

Monitor and Adjust

Regularly review and adjust your budget as needed. Keep track of all expenditures and ensure you stay within your financial limits.

7. Seek Professional Advice

Consult Real Estate Professionals

Engage with experienced real estate agents, lawyers, and notaries who are familiar with the Lombok property market. Their expertise can help you navigate the process smoothly and avoid potential pitfalls.

Financial Advisors

Consider consulting a financial advisor to help you plan and manage your budget effectively. They can provide valuable insights and strategies tailored to your financial situation.

Summary of Budgeting Steps for Lombok Property Purchase

- Determine Your Property Budget: Assess your financial situation and set a maximum budget.

- Research Property Prices in Lombok: Understand market trends and compare different areas.

- Factor in Additional Costs: Include notary fees, transfer tax, legal fees, agent fees, survey and inspection fees, administration fees, property maintenance, insurance, and renovation costs.

- Plan for Ongoing Costs: Account for utilities, maintenance, and property taxes.

- Secure Financing if Needed: Explore mortgage options and alternative financing methods.

- Create a Detailed Budget Plan: Use a budget template to track expenses and adjust as needed.

- Seek Professional Advice: Consult real estate professionals and financial advisors.

FAQs

What are the typical costs involved in buying property in Lombok?

Typical costs include the property price, notary fees (1-2%), transfer tax (5%), legal fees, real estate agent fees (5%), survey and inspection fees, administration fees, property maintenance, insurance, and renovation costs.

Can foreigners buy property in Lombok?

Yes, but foreigners cannot own freehold land directly. They can acquire property through Hak Pakai (Right to Use), Hak Guna Bangunan (Right to Build), or Hak Sewa (Leasehold).

How can I finance a property purchase in Lombok?

Financing options include local mortgages, personal loans, borrowing from family or friends, or financing from international banks.

What ongoing costs should I plan for when buying property in Lombok?

Ongoing costs include utilities, maintenance, property taxes, and property management fees if you’re not residing full-time.

Is property insurance necessary in Lombok?

Property insurance is recommended to protect your investment from potential risks such as natural disasters, theft, and damage.

Conclusion

Budgeting for a property purchase in Lombok requires careful planning and consideration of all associated costs. You can ensure a smooth and successful property purchase by understanding the market, accounting for additional expenses, and seeking professional advice. With its stunning scenery and welcoming community, Lombok offers a beautiful and tranquil environment for your new home or investment.

About Nour Estates

We started Nour Estates with a simple idea: to make finding your dream land in Lombok as easy and enjoyable as a day at the beach. Our team is a mix of local folks and people from around the world who fell in love with Lombok just like you. We’ve been in your shoes, faced the challenges of buying land here, and learned all the ins and outs. Now, we’re here to share that knowledge with you.

We are here to find you the perfect land to invest in. Contact us today, and let’s start this exciting journey together!

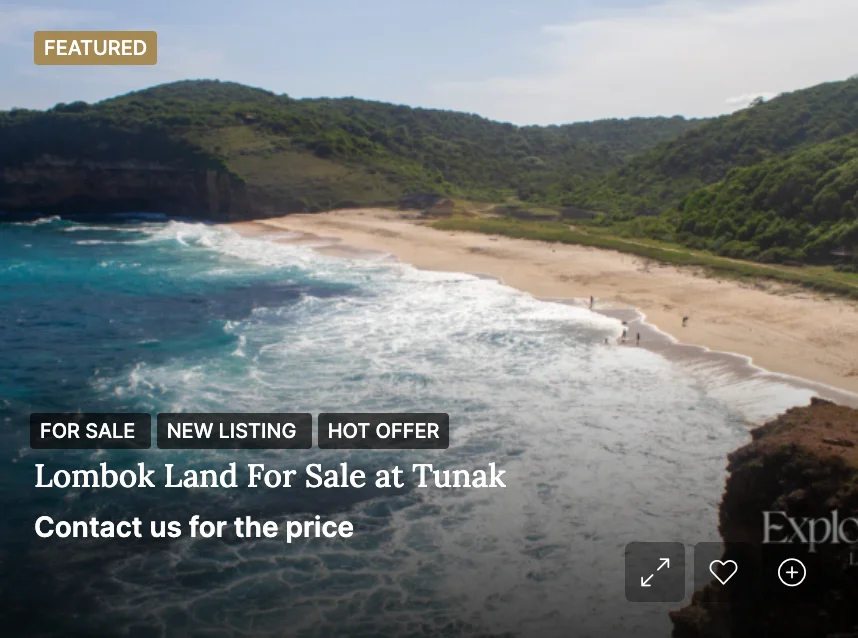

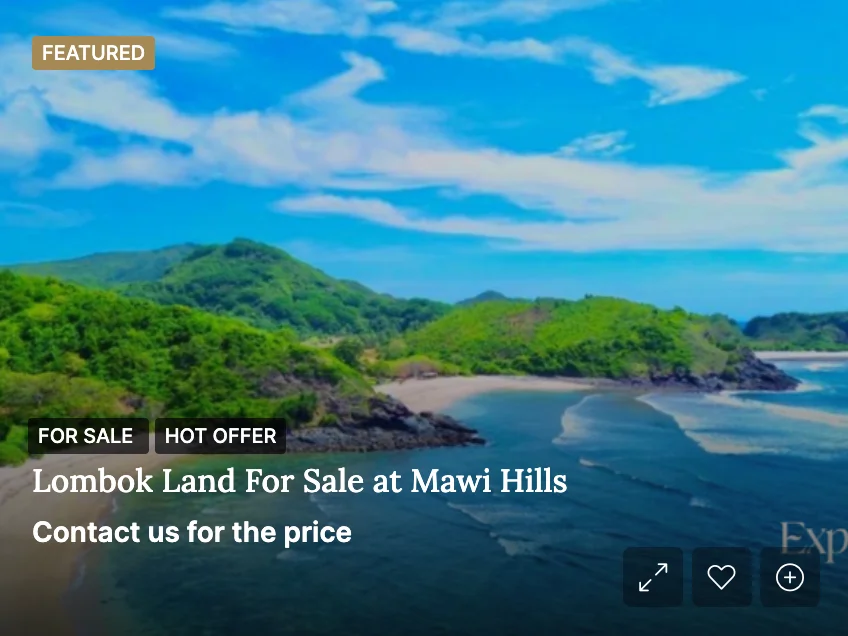

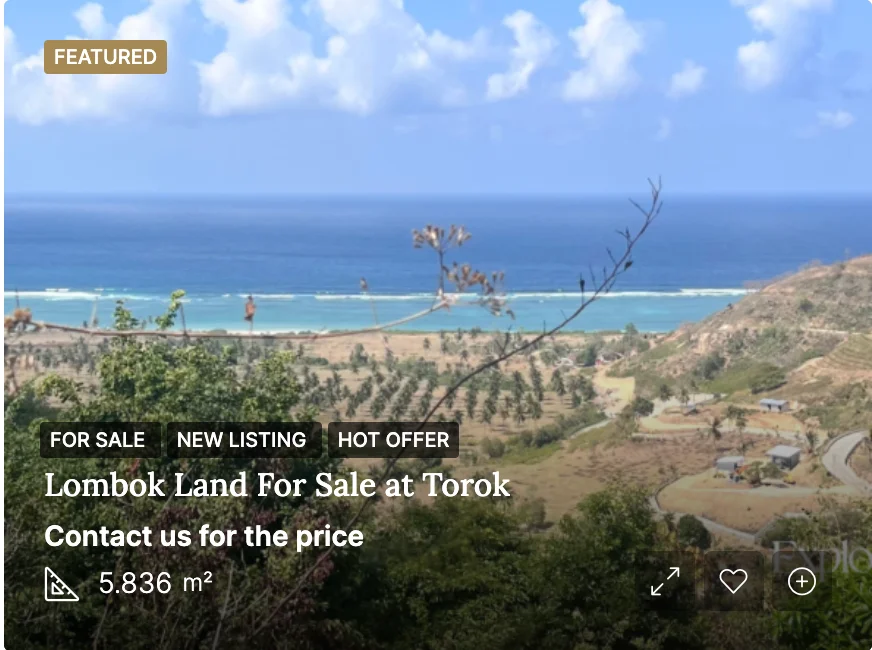

Looking for land to build your dream villa in Lombok? Discover our exclusive lands below: