Last Updated on June 25, 2024 by Yasmina

Starting a business in Indonesia can be rewarding, especially with the country’s growing economy and strategic location in Southeast Asia. One of the most common business structures for foreign investors is the PT PMA (Penanaman Modal Asing), or Foreign Investment Limited Liability Company.

This guide explains what a PT PMA is and provides detailed steps on how to establish one in Indonesia.

Table of Contents

Introduction

A PT PMA is a legal entity established in Indonesia with foreign shareholders. This type of company structure allows foreign investors to operate and conduct business activities within the country. Understanding the process and requirements for setting up a PT PMA is crucial for ensuring compliance with Indonesian laws and regulations.

What is a PT PMA?

A PT PMA (Penanaman Modal Asing) is a Foreign Investment Limited Liability Company that permits foreign individuals or entities to invest in and own a business in Indonesia. It is governed by the Indonesian Investment Coordinating Board (BKPM), which regulates foreign investment activities in the country.

Benefits of a PT PMA

- Legal Protection: A PT PMA provides legal protection and a clear regulatory framework for foreign investors.

- Ownership Rights: Foreign investors can own up to 100% of the shares in certain business sectors, depending on the Negative Investment List (DNI), which outlines restricted sectors.

- Business Opportunities: Access to Indonesia’s vast market and potential for business growth.

- Ease of Operation: Ability to conduct a wide range of business activities legally.

- Profit Repatriation: Profits can be repatriated to the foreign investor’s home country, subject to applicable taxes and regulations.

Requirements for Setting Up a PT PMA

- Minimum Capital Requirement: As of the latest regulations, the minimum authorized capital for a PT PMA is IDR 10 billion (approximately USD 700,000), with at least 25% of the capital (IDR 2.5 billion or approximately USD 175,000) paid up before incorporation.

- Shareholders: A PT PMA must have at least two shareholders. These can be individuals or corporate entities.

- Directors and Commissioners: At least one director and one commissioner are required. These positions can be held by foreigners or Indonesians.

- Business Fields: The intended business activities must be specified and comply with the Negative Investment List (DNI), which outlines sectors restricted or closed to foreign investment.

- Office Address: A registered office address in Indonesia is mandatory.

Step-by-Step Process to Establish a PT PMA

1. Prepare Required Documents

- Articles of Association: Draft the company’s Articles of Association, which outline the company’s structure, shareholders, directors, and business activities.

- Shareholder Identification: Provide identification documents for all shareholders, directors, and commissioners (e.g., passports for individuals and incorporation documents for corporate entities).

- Office Lease Agreement: A lease agreement for the registered office address.

2. Name Reservation

- Submit an application to reserve the company name with the Ministry of Law and Human Rights. The name must be unique and comply with Indonesian naming conventions.

3. Obtain Investment Approval

- Apply for investment approval from the Indonesian Investment Coordinating Board (BKPM). This involves submitting the Articles of Association, shareholder information, and business plan.

4. Establishment Deed

- Engage a notary public to draft and notarize the Deed of Establishment, which includes the Articles of Association and details of the shareholders, directors, and commissioners.

5. Legalization

- The notary will submit the Deed of Establishment to the Ministry of Law and Human Rights for approval and legalization. Once approved, the company obtains a Decree of Establishment.

6. Business Identification Number (NIB)

- Register for a Business Identification Number (Nomor Induk Berusaha or NIB) through the Online Single Submission (OSS) system. The NIB is the company’s primary business license and is necessary for all business activities.

7. Additional Licenses and Permits

- Depending on the business activities, additional licenses and permits may be required from relevant authorities. This can include sector-specific licenses, operational permits, and environmental permits.

8. Tax Registration

- Register the company with the local tax office to obtain a Taxpayer Identification Number (NPWP). This is necessary for fulfilling tax obligations.

9. Capital Injection

- Deposit the minimum paid-up capital (IDR 2.5 billion) into the company’s Indonesian bank account. Proof of this deposit must be submitted to the relevant authorities.

10. Employment and Work Permits

- If hiring foreign employees, obtain the necessary work permits (KITAS) and report them to the Ministry of Manpower.

Summary of Steps to Establish a PT PMA

| Step | Description |

|---|---|

| 1. Prepare Required Documents | Articles of Association, shareholder IDs, office lease agreement |

| 2. Name Reservation | Reserve company name with the Ministry of Law and Human Rights |

| 3. Obtain Investment Approval | Submit application to BKPM |

| 4. Establishment Deed | Draft and notarize the Deed of Establishment |

| 5. Legalization | Obtain Decree of Establishment from the Ministry of Law and Human Rights |

| 6. Business Identification Number (NIB) | Register through OSS system |

| 7. Additional Licenses and Permits | Obtain sector-specific licenses, operational permits |

| 8. Tax Registration | Register for Taxpayer Identification Number (NPWP) |

| 9. Capital Injection | Deposit minimum paid-up capital into Indonesian bank account |

| 10. Employment and Work Permits | Obtain work permits for foreign employees (if applicable) |

FAQs

What is the minimum capital requirement for a PT PMA?

The minimum authorized capital for a PT PMA is IDR 10 billion (approximately USD 700,000), with at least 25% of the capital (IDR 2.5 billion or approximately USD 175,000) paid-up before incorporation.

Can foreigners fully own a PT PMA in Indonesia?

Yes, foreigners can own up to 100% of the shares in a PT PMA, depending on the business sector and compliance with the Negative Investment List (DNI).

How long does it take to establish a PT PMA in Indonesia?

The process can take anywhere from 1 to 3 months, depending on the completeness of the documents and the efficiency of the regulatory authorities.

Are there any restricted sectors for foreign investment in Indonesia?

Yes, the Negative Investment List (DNI) outlines sectors that are restricted or closed to foreign investment. It is important to review this list before planning your business activities.

What are the benefits of setting up a PT PMA?

A PT PMA provides legal protection, ownership rights, access to Indonesia’s market, the ability to conduct a wide range of business activities legally, and the ability to repatriate profits.

Conclusion

Setting up a PT PMA in Indonesia can be a complex process, but it offers significant benefits for foreign investors looking to tap into Indonesia’s growing market. By understanding the requirements and following the proper steps, you can establish your business successfully and enjoy the opportunities that come with investing in this dynamic country.

About Nour Estates

We started Nour Estates with a simple idea: to make finding your dream land in Lombok as easy and enjoyable as a day at the beach. Our team is a mix of local folks and people from around the world who fell in love with Lombok just like you. We’ve been in your shoes, faced the challenges of buying land here, and learned all the ins and outs. Now, we’re here to share that knowledge with you.

We are here to find you the perfect land to invest in. Contact us today, and let’s start this exciting journey together!

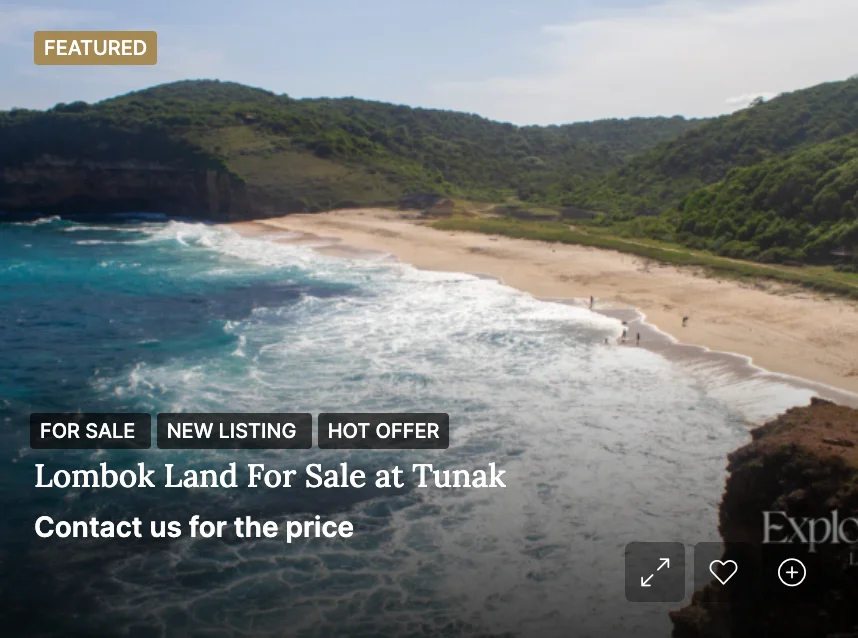

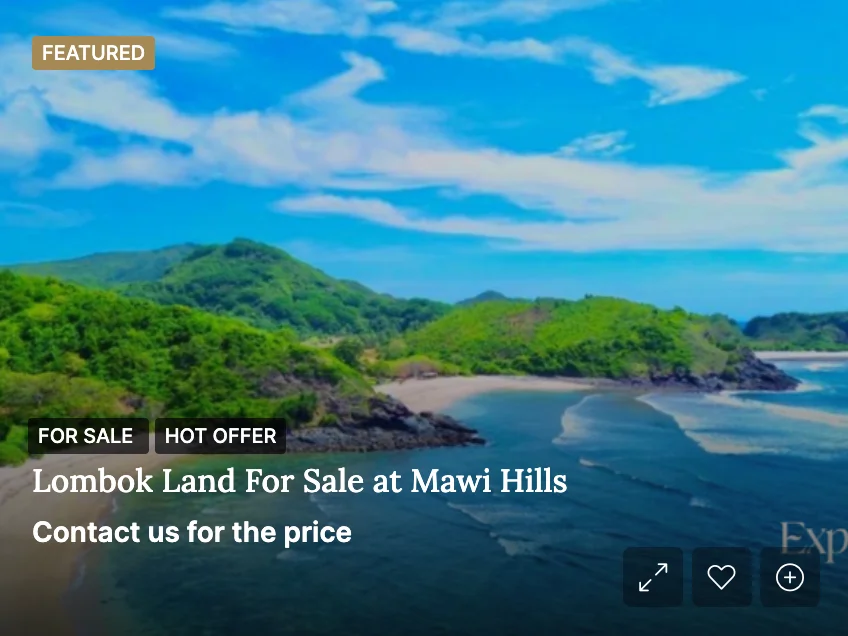

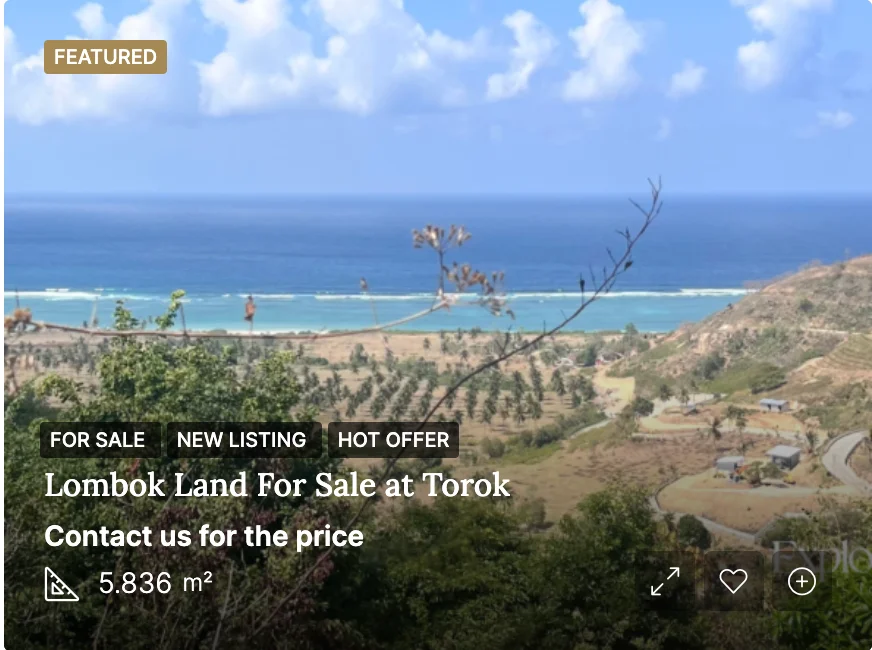

Looking for land to build your dream villa in Lombok? Discover our exclusive lands below: